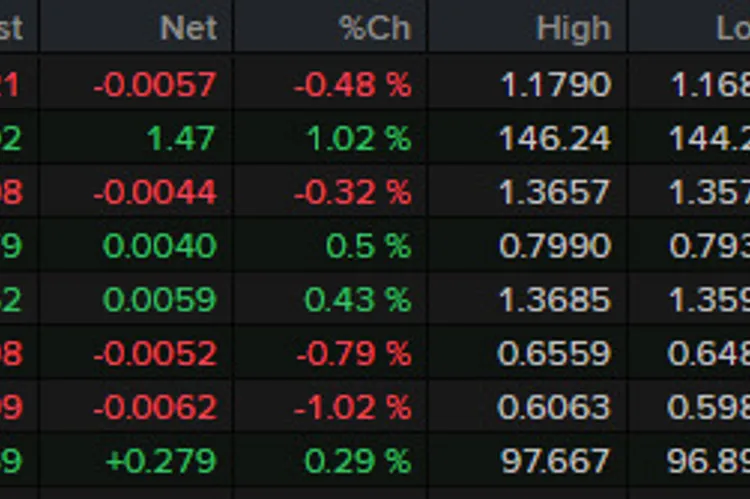

Trump rolls out higher tariffs for Aug 1 for 7 countries US President Donald Trump announced a new wave of tariffs set to take effect on August 1st, impacting a range of products from Japan, Malaysia, and South Africa, alongside several other nations. This escalation in trade tensions has significant implications for global markets and currency movements. The initial reaction to the announcement was characterized by a cautious assessment, with the market appearing to ‘sniff out some trouble’ and resulting in a brief USD rally. However, the subsequent announcement of 25% tariffs on Japan and South Korea, coupled with the addition of five further countries, triggered renewed risk aversion and a surge in USD buying. This prompted a sharp decline in the euro, reaching a session low of 1.1688 before bouncing back to 1.1720. The USD’s strength was initially fueled by this heightened risk sentiment, but the impact was partially offset by the European market close.

Beyond the tariff announcements, several other market developments shaped the trading session. US shares experienced a downturn, with Tesla shares plummeting due to Elon Musk’s continued focus on political matters rather than the company’s automotive operations. This highlights the growing influence of Musk’s statements on investor confidence. The US Dollar (USD) continued to demonstrate strength, benefiting from the increased risk aversion surrounding the trade developments. The market closely monitored the performance of the Japanese Yen (JPY), which exhibited weakness throughout the day, declining from 144.25 to 146.10. This weakening trend underscored the sensitivity of the currency to global trade uncertainties. The USD’s strength was largely driven by the heightened risk sentiment.

Crude oil prices also experienced a volatile session. Initially, an OPEC production boost led to an early decline in WTI crude oil prices. However, a subsequent ‘post-OPEC squeeze,’ fueled by speculation regarding under-curbed production levels and persistent global inventory tightness, ultimately resulted in a $1 increase in prices. This dynamic fluctuation reflects the complex interplay of supply and demand forces within the energy market. The OPEC production boost initially caused a drop in prices, but the subsequent ‘post-OPEC squeeze’ reversed this trend, illustrating the complexities of the energy market.

Gold prices, on the other hand, demonstrated resilience, steadily climbing higher to offset an earlier $35 decline, demonstrating investor preference for safe-haven assets during times of economic uncertainty. This indicates a shift in investor sentiment towards safer assets as global economic uncertainty increased. The rise in gold prices reflects investors' desire for safe havens during turbulent market conditions. The initial $35 decline was quickly countered by a sustained upward trend, highlighting the appeal of gold as a safe investment option.

Looking ahead, the Reserve Bank of Australia (RBA) meeting at 12:30 am ET is a key event. The market anticipates a 25 basis point (25 bps) interest rate cut, which is largely priced in. The AUD/USD pair traded near 0.6500, reflecting the expected outcome. The decision will undoubtedly influence the pair’s trajectory, and traders will be closely watching for any signals regarding the RBA’s future monetary policy stance. The ongoing trade tensions and the RBA decision create a complex environment for market participants, requiring careful monitoring of global economic indicators and geopolitical developments. The continued volatility in the USD and JPY further emphasizes the interconnectedness of global financial markets and the potential impact of trade policies on currency valuations. The RBA meeting's outcome will significantly impact the AUD/USD pair, and traders will be closely observing the RBA's future monetary policy.